Alcohol-Free Beer Market to Surge to USD 37.8 Billion by 2034, Comprehensive Insights: Heineken, Brooklyn Brewery

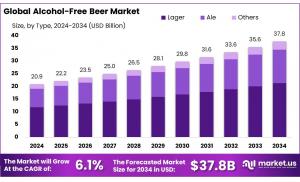

Alcohol-Free Beer Market size is expected to be worth around USD 37.8 Billion by 2034, from USD 20.9 Billion in 2024, growing at a CAGR of 6.1%.

North America is projected to witness substantial growth From. In 2024, the region accounted for a significant market revenue share of 46.3% in the global Alcohol-Free Beer market.”

NEW YORK, NY, UNITED STATES, March 5, 2025 /EINPresswire.com/ -- 𝐀𝐥𝐜𝐨𝐡𝐨𝐥-𝐅𝐫𝐞𝐞 𝐁𝐞𝐞𝐫 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰— Tajammul Pangarkar

The Global 𝐀𝐥𝐜𝐨𝐡𝐨𝐥-𝐅𝐫𝐞𝐞 𝐁𝐞𝐞𝐫 𝐌𝐚𝐫𝐤𝐞𝐭 size is projected to grow from 𝐔𝐒𝐃 𝟐𝟎.𝟗 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐢𝐧 𝟐𝟎𝟐𝟒 𝐭𝐨 𝐚𝐩𝐩𝐫𝐨𝐱𝐢𝐦𝐚𝐭𝐞𝐥𝐲 𝐔𝐒𝐃 𝟑𝟕.𝟖 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐛𝐲 𝟐𝟎𝟑𝟒, with a Compound Annual Growth Rate (𝐂𝐀𝐆𝐑) 𝐨𝐟 𝟔.𝟏%. This expansion is primarily driven by changing consumer preferences, increasing health consciousness, and the growing availability of non-alcoholic alternatives. Alcohol-free beer caters to individuals who prefer beverages low in alcohol content, which are perceived as healthier alternatives without compromising on taste. Recent innovations have broadened the spectrum of alcohol-free products, ranging from traditional lagers to flavored varieties like India Pale Ales (IPAs) and stouts, allowing for enhanced consumer choice.

Geographically, regions with stringent alcohol consumption regulations, such as the Middle East, have shown significant demand for these products, enhancing the market's global footprint. Furthermore, global campaigns like "Dry January" and initiatives promoting alcohol moderation have boosted the acceptance of alcohol-free beers, with key markets being North America and Europe. Major players like Heineken and AB InBev are capitalizing on these trends by expanding their alcohol-free product lines, contributing to this sector's robust growth.

𝐊𝐞𝐲 𝐓𝐚𝐤𝐞𝐚𝐰𝐚𝐲𝐬

➡️ The market was valued at 𝐔𝐒𝐃 𝟐𝟎.𝟗 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐢𝐧 𝟐𝟎𝟐𝟒, 𝐟𝐨𝐫𝐞𝐜𝐚𝐬𝐭𝐞𝐝 𝐭𝐨 𝐫𝐞𝐚𝐜𝐡 𝐔𝐒𝐃 𝟑𝟕.𝟖 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐛𝐲 𝟐𝟎𝟑𝟒.

➡️ The 𝐥𝐚𝐠𝐞𝐫 𝐬𝐞𝐠𝐦𝐞𝐧𝐭 dominated the product type market with a 𝟓𝟔.𝟒% share.

➡️ 𝐏𝐥𝐚𝐢𝐧 𝐚𝐥𝐜𝐨𝐡𝐨𝐥-𝐟𝐫𝐞𝐞 𝐛𝐞𝐞𝐫𝐬 accounted for the largest market share at 𝟕𝟑.𝟒%.

➡️ 𝐏𝐡𝐲𝐬𝐢𝐜𝐚𝐥 𝐩𝐫𝐨𝐝𝐮𝐜𝐭𝐢𝐨𝐧 𝐦𝐞𝐭𝐡𝐨𝐝𝐬 are preferred, holding 𝟔𝟓.𝟒% market share.

➡️ 𝐂𝐚𝐧 𝐩𝐚𝐜𝐤𝐚𝐠𝐢𝐧𝐠 leads with a 𝟓𝟕.𝟏% revenue share.

➡️ 𝐒𝐮𝐩𝐞𝐫𝐦𝐚𝐫𝐤𝐞𝐭𝐬 𝐚𝐧𝐝 𝐡𝐲𝐩𝐞𝐫𝐦𝐚𝐫𝐤𝐞𝐭𝐬 dominate distribution, capturing 𝟒𝟐.𝟑% of market share.

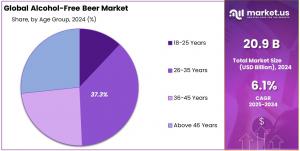

➡️ People aged 𝟐𝟔-𝟑𝟓 𝐫𝐞𝐩𝐫𝐞𝐬𝐞𝐧𝐭 𝟑𝟕.𝟑% of market revenue.

➡️ 𝐌𝐚𝐥𝐞𝐬 constitute 𝟓𝟖.𝟔% of the consumer base in 2024, showing preference for alcohol-free options.

➤ 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐑𝐞𝐪𝐮𝐞𝐬𝐭: 𝐔𝐧𝐥𝐨𝐜𝐤 𝐕𝐚𝐥𝐮𝐚𝐛𝐥𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝐘𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/report/global-alcohol-free-beer-market/free-sample/

𝐄𝐱𝐩𝐞𝐫𝐭𝐬 𝐑𝐞𝐯𝐢𝐞𝐰

Government incentives and regulatory shifts are pivotal as they shape the market landscape. Encouraging policies aimed at promoting low-alcohol products can provide an edge to market participants. Technologically, advancements such as membrane technology and customized fermentation processes are enhancing product offerings and expanding consumer reach. Investment opportunities abound, propelled by rising health trends and consumer affinity for alcohol-free options, albeit with inherent risks linked to market saturation and regulatory compliance challenges. Growing consumer awareness, driven by health motivations and digital influences, supports market dynamics by encouraging trial and broader adoption. On the regulatory front, global variations necessitate strategic alignment, shaping market entry and expansion strategies.

📈 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧

𝐏𝐫𝐨𝐝𝐮𝐜𝐭 𝐓𝐲𝐩𝐞 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

The lager segment dominates the global alcohol-free beer market with a 𝟓𝟔.𝟒% share, primarily due to its smooth, crisp flavor that mimics traditional beer, appealing nutritional content, and mood-enhancing properties. Originating from Pilsen in Bohemia as Pilsner lager or Pils, non-alcoholic lager is prized for its light and refreshing taste, resulting from a fermentation process similar to that of regular lager but with alcohol removed. This segment is growing as major breweries introduce non-alcoholic versions of popular lagers to meet the increasing demand for healthier beverage options. For instance, IMPOSSIBREW has introduced innovative brewing technologies like the Social Blend to replicate the relaxing effects of alcohol. A survey by IMPOSSIBREW found that 70.6% of 775 customers appreciate these relaxation benefits, and non-alcoholic lager typically contains about 20 kcal per 100 ml—half the calories of its alcoholic counterparts.

𝐂𝐚𝐭𝐞𝐠𝐨𝐫𝐲 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

In the global alcohol-free beer market, there are two primary segments: plain and flavored. The plain alcohol-free beer category is the more prominent of the two, capturing a significant 𝟕𝟑.𝟒% market share. These beers are favored for their traditional beer-like qualities—malty flavors and familiar aromas—without the alcohol, appealing to those who appreciate the classic beer taste. Popular brands in this segment include Heineken 0.0, Clausthaler Original, and Guinness 0.0. Brewed using traditional methods, the alcohol in these beers is removed via techniques like vacuum distillation and reverse osmosis, preserving the original flavors while appealing to health-conscious consumers with their lower calorie count.

𝐏𝐫𝐨𝐝𝐮𝐜𝐭𝐢𝐨𝐧 𝐌𝐞𝐭𝐡𝐨𝐝 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

When it comes to production methods in the alcohol-free beer market, physical processes take the lead, holding a substantial 𝟔𝟓.𝟒% of the market due to their ability to maintain the sensory properties of beer while removing alcohol. Techniques like thermal treatments and membrane separation are popular, with methods such as falling film evaporation and reverse osmosis being particularly effective. These methods are energy-efficient and less costly, aligning well with modern brewing requirements and environmental considerations.

𝐏𝐚𝐜𝐤𝐚𝐠𝐢𝐧𝐠 𝐓𝐲𝐩𝐞 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

Regarding packaging, cans are the preferred choice in the alcohol-free beer market, representing 𝟓𝟕.𝟏% of the market in 2024. The convenience, portability, and aesthetic appeal of cans, along with their sustainability benefits, make them highly attractive. Cans are often chosen for their matte finishes and corrosion-resistant internal coatings. With a high recyclability rate, particularly for aluminum, cans offer a blend of practicality and environmental responsibility, which is increasingly important to consumers.

𝐃𝐢𝐬𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧 𝐂𝐡𝐚𝐧𝐧𝐞𝐥 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

Supermarkets and hypermarkets are the leading distribution channels for alcohol-free beer, accounting for 𝟒𝟐.𝟑% of the market. These retailers offer a broad selection of non-alcoholic beers, ranging from established brands to craft alternatives, providing a convenient shopping experience. The wide array of choices, combined with strategic marketing and promotional activities, helps maintain their dominance in the market.

𝐀𝐠𝐞 𝐆𝐫𝐨𝐮𝐩 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

The 26-35 age group is a key demographic in the alcohol-free beer market, holding 𝟑𝟕.𝟑% of the market share in 2024. This segment is driven by a commitment to health and wellness, with a preference for beers that are both flavorful and functional. Brands that cater to this group often focus on sophisticated, health-conscious products, including those with added vitamins or probiotics, packaged in an eco-friendly manner. This demographic's tech-savvy nature also makes them susceptible to online marketing and influencer endorsements, which play a significant role in their purchasing decisions.

𝐄𝐧𝐝-𝐮𝐬𝐞𝐫 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

Men dominate the alcohol-free beer market, with a significant 𝟓𝟖.𝟔% share. The trend towards healthier lifestyle choices without sacrificing social rituals is particularly strong among this group. Alcohol-free beers appeal to men who are mindful of their health and often engage in fitness activities, seeking out beers with lower calories and enhanced nutritional profiles. Marketing efforts in this segment frequently emphasize the beer's authentic taste and connection to sports and outdoor activities.

➤ 𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐆𝐫𝐨𝐰 𝐲𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/purchase-report/?report_id=141968

𝐊𝐞𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐬

By Product Type

— Lager

— Ale

— Other

By Category

— Plain

— Flavor

By Production Type

— Physical

——— Thermal

——— Membrane

——— Others

— Biological

——— Traditional

——— Continuous Fermentation

By Packaging Type

— Can

— Bottles

Based on Distribution Channel

— Supermarkets/Hypermarkets

— Convenience Stores

— Specialty Stores

— Online Retail

— Others

By Age Group

— 18-25 Years

— 26-35 Years

— 36-45 Years

— Above 46 Years

Based on End-users

— Male

— Female

𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

⦿ Bavarian State Brewery Weihenstephan

⦿ Anheuser-Busch InBev

⦿ Heineken N.V.

⦿ Coors Brewing Company

⦿ BERNARD Family Brewery, a.s.

⦿ Athletic Brewing Company

⦿ Moscow Brewing Company

⦿ Big Drop Brewing Pty Ltd

⦿ Carlsberg Breweries A/S

⦿ Bravus Brewing Company

⦿ Brooklyn Brewery

⦿ ERDINGER Weißbier

⦿ Krombacher Startseite

⦿ Swinkels Family Brewers

⦿ Other Key Players

𝐃𝐫𝐢𝐯𝐞𝐫𝐬, 𝐑𝐞𝐬𝐭𝐫𝐚𝐢𝐧𝐭𝐬, 𝐂𝐡𝐚𝐥𝐥𝐞𝐧𝐠𝐞𝐬, 𝐚𝐧𝐝 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬

Drivers: Health and wellness trends and a growing movement towards mindful drinking fuel market growth, complementing technological advancements in brewing. Alcohol-free beer is increasingly associated with various health benefits, including reduced calorie intake and hydrating properties appealing to fitness-conscious consumers.

Restraints: Regulatory challenges, such as labeling requirements and alcohol content limits, pose obstacles. Compliance demands significant investment in quality control and approval processes, inhibiting swift market entry and growth.

Challenges: Navigating diverse and dynamic consumer preferences and maintaining consistent product quality across regions is challenging. Rapidly evolving consumer expectations necessitate continuous innovation and market readiness.

Opportunities: Flavor innovation and craft-style productions offer substantial opportunities. Advanced brewing techniques and strategic branding create room for premium, aspirational positioning, allowing brands to capture new market segments and engage health and lifestyle influencers for broader reach.

𝐑𝐞𝐜𝐞𝐧𝐭 𝐃𝐞𝐯𝐞𝐥𝐨𝐩𝐦𝐞𝐧𝐭𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐀𝐥𝐜𝐨𝐡𝐨𝐥-𝐅𝐫𝐞𝐞 𝐁𝐞𝐞𝐫 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲

𝐈𝐧 𝐍𝐨𝐯𝐞𝐦𝐛𝐞𝐫 𝟐𝟎𝟐𝟒, 𝐇𝐄𝐈𝐍𝐄𝐊𝐄𝐍 𝐝𝐞𝐜𝐥𝐚𝐫𝐞𝐝 𝐚𝐧 𝐢𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐨𝐟 €𝟒𝟓 𝐦𝐢𝐥𝐥𝐢𝐨𝐧 to establish the Dr. H.P. Heineken Centre for Global R&D in Zoeterwoude, expected to open by mid-2025. This 8,800 m² facility will enhance product lines and foster innovation across major brands such as Heineken, Desperados, and Amstel, incorporating offices, labs, and sensory research units.

𝐀𝐧𝐡𝐞𝐮𝐬𝐞𝐫-𝐁𝐮𝐬𝐜𝐡, a major player in the American brewing industry, introduced Michelob ULTRA Zero in September 2024. This premium alcohol-free beer is tailored for individuals over 21, aligning with active lifestyles and expanding the company's portfolio in response to increasing consumer demand for non-alcoholic options.

𝐀𝐭𝐡𝐥𝐞𝐭𝐢𝐜 𝐁𝐫𝐞𝐰𝐢𝐧𝐠 𝐂𝐨𝐦𝐩𝐚𝐧𝐲, the leading non-alcoholic brewery in the U.S., successfully completed a $50 million equity financing round in July 2024, led by General Atlantic. This funding will facilitate the acquisition of a third brewing facility in the U.S. and help expand its non-alcoholic beer market presence globally.

Lawrence John

Prudour

+91 91308 55334

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.