Latest Alternative Protein in North America Market | Opportunities, Trends 2025-2032

North America’s alternative protein market is set to surge, driven by health, sustainability, and food innovation

The U.S. alternative protein market, valued at $2,735.29M in 2024, is set to hit $9,874.61M by 2032, fueled by health and sustainability demand 2025-2032”

SAN FRANCISCO, IL, UNITED STATES, August 26, 2025 /EINPresswire.com/ -- North America Alternative Protein Market Overview— DataM Intelligence 4Market Research LLP

The way people in North America think about protein is changing. For decades, meat dominated the dinner plate. But today, health-conscious consumers, sustainability advocates, and innovative food companies are reshaping the conversation around what protein should look like. This shift is fueling a rapidly growing alternative protein market spanning plant-based, fermented, and cultivated (lab-grown) proteins.

Market Size and Growth

According to DataM Intelligence, the North America Alternative Protein industry was worth about US$ 2,735.29 million in 2024 and is expected to climb to nearly US$ 9,874.61 million by 2032, growing at a 17.6% CAGR 2025-2032. That’s more than just a passing trend it’s a structural shift in the region’s food system.

Get a Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/north-america-alternative-protein-market

Why Consumers Are Making the Switch?

Health First

. One of the biggest drivers of this transition is health. The American Heart Association (AHA) reports that eating more plant-based protein and less red or processed meat can lower the risk of heart disease by as much as 29–47%. Unlike meat, beans, lentils, peas, nuts, and soy contain zero cholesterol and are rich in fiber, vitamins, and minerals.

. The FDA has also updated how it defines “healthy” foods, with plant-based protein products often checking the right boxes low in saturated fats and high in beneficial nutrients. For consumers, this makes plant proteins a natural fit in a healthier lifestyle.

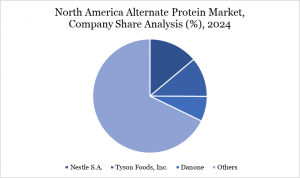

Key Players

Nestle S.A.

Tyson Foods, Inc.

Danone

Cargill Incorporated

Archer Daniels Midland Company

Buy Now & Unlock 360° Market Intelligence:- https://www.datamintelligence.com/buy-now-page?report=north-america-alternative-protein-market

The Environmental Angle

. It’s not just personal health. The environmental story is equally powerful. Studies show that plant-based proteins require up to 99% less water, 90% less greenhouse gas emissions, and nearly 99% less land compared to conventional meat. In a region where climate impact is increasingly top of mind, this is a persuasive selling point.

A Market with Strong Momentum - But Real Challenges

. Despite the promise, the alternative protein market isn’t without hurdles. According to the Good Food Institute, sales of plant-based meat products in the U.S. actually declined between 2021 and 2023, with a 13% drop in dollar sales and a 26% drop in unit sales.

Why? Three main reasons keep coming up:

1. Price premiums – Plant-based products often cost 50–150% more than chicken or beef.

2. Taste and texture – Some consumers try once and don’t come back.

3. Perception – Heavily processed ingredient lists have created skepticism around “healthiness.”

For example, Beyond Meat, a pioneer in the space, generated US $326 million in revenues in 2024 but still posted a net loss of US $160 million. While it’s available in tens of thousands of retail locations, profitability remains elusive.

The lesson? While demand exists, companies must crack the code on affordability, sensory quality, and consumer trust.

Innovation: The Next Chapter

1. The industry isn’t standing still. Leading brands are reformulating with simpler ingredient lists, better textures, and improved nutrition profiles. Consumers increasingly want “clean-label” products that don’t feel overly engineered.

2. But the biggest buzz lies in cultivated meat real animal meat grown from cells. Upside Foods recently secured USDA approval for its cultivated chicken and is building a commercial-scale facility in Illinois. This milestone shows that the future may include meat without slaughter.

3. Beyond that, startups are using AI and machine learning to accelerate cell-line development and bioprocess design, potentially cutting years off the commercialization timeline. If scaled successfully, cultivated proteins could tackle both the sustainability and sensory challenges currently facing plant-based products.

Investments Are Flowing

Investor interest is still strong. Since 2010, global funding into alternative proteins has topped US $11 billion, with more than US $5 billion raised in 2021 alone. North America continues to attract a significant share of this capital, reflecting both consumer demand and the region’s biotech ecosystem.

For retailers and foodservice providers, this investment means a wider variety of options hitting shelves and menus from pea protein burgers to cultivated chicken nuggets to precision-fermented dairy proteins.

DataM Intelligence: Strategic Pathways Forward

Based on its market research, DataM Intelligence highlights five recommendations for companies looking to succeed in this space:

1. Focus on Clean Labels

Products with simpler, natural ingredients resonate more strongly with health-conscious buyers.

2. Close the Price Gap

Scale manufacturing and improve supply chains to reduce the cost disadvantage against traditional meat.

3. Prioritize Sensory Experience

Taste and texture will make or break consumer loyalty invest in R&D to get it right.

4. Engage Regulators and Build Trust

Work closely with the FDA and USDA to ensure products meet updated standards for health and safety, while marketing responsibly.

5. Diversify Protein Portfolios

Look beyond plant-based into cultivated and fermented proteins, where long-term growth potential is enormous.

Conclusion

The North American alternative protein market is at a fascinating crossroads. On one hand, health and sustainability concerns are fueling rapid growth potential, with the market set to nearly quadruple by 2032. On the other hand, issues around pricing, taste, and consumer trust have slowed adoption in the short term.

If companies can align innovation with affordability and clean-label positioning, alternative proteins will shift from niche to mainstream. As DataM Intelligence points out, those who invest in the right mix of cost efficiency, sensory quality, and regulatory credibility will be best placed to lead in this next wave of food transform

Why Choose This North America Alternative Protein Market Report?

1. Latest Data & Forecasts: Comprehensive analysis with validated projections through 2032, covering plant-based, fermented, and cultivated proteins.

2. Health & Regulatory Insights: Impact of FDA guidelines, USDA approvals, and evolving nutrition labeling standards on product innovation and consumer trust.

3. Competitive Benchmarking: Detailed profiles of leading players such as Beyond Meat, Impossible Foods, Upside Foods, ADM, and Maple Leaf Foods, alongside emerging startups.

4. Regional Dynamics: Focused analysis of key markets in the U.S. and Canada, with insights on consumer adoption patterns, retail penetration, and foodservice partnerships.

5. Actionable Strategies: Recommendations on clean-label positioning, pricing strategies, taste and texture innovation, and cultivated protein commercialization.

6. Expert Analysis: Developed by DataM Intelligence, leveraging the expertise of industry specialists with proven track records in food technology and market intelligence.

7. Empower your business to navigate health-driven demand, regulatory shifts, and sustainability imperatives. Request your sample or full report today to stay ahead in the fast-evolving alternative protein landscape.

Latest People Also Ask For Related Reports By DataM Intelligence

Alternative Proteins Market Size

Protein Market Size

Sai Kiran

DataM Intelligence 4Market Research LLP

+1 877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.