Global Eye Health Supplements Market Eyes $3.9 Billion by 2032, Driven by Aging & Screen-Time Surge

Digital lifestyles, aging populations, and clinically proven nutrients like lutein and zeaxanthin fuel worldwide demand.

Vision care is becoming preventive, not reactive. As screen fatigue and aging rise, clinically validated supplements redefine daily wellness for all generations.”

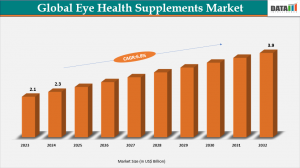

AUSTIN, TX, UNITED STATES, October 15, 2025 /EINPresswire.com/ -- The global eye health supplements market is undergoing rapid transformation, catalyzed by shifting demographics, surging screen time, and increasing recognition of vision health as a cornerstone of wellbeing. According to DataM Intelligence, the market reached a valuation of US$ 2.3 billion in 2024 and is expected to soar to US$ 3.9 billion by 2032, driven by a CAGR of 6.8% over 2025–2032. Key ingredients such as lutein, zeaxanthin, and omega-3 fatty acids have become staples due to their scientifically validated roles in supporting vision, particularly for aging populations and those suffering from digital eye strain. Segment analysis highlights that the tablet formulation leads the market, and North America remains the largest regional contributor. This dynamic expansion is being further accelerated by proactive wellness culture, technological advances in supplement delivery, and ever-growing digital dependence across age groups.— DataM Intelligence

𝗚𝗲𝘁 𝗮 𝗦𝗮𝗺𝗽𝗹𝗲 𝗣𝗗𝗙 𝗕𝗿𝗼𝗰𝗵𝘂𝗿𝗲 𝗼𝗳 𝘁𝗵𝗲 𝗥𝗲𝗽𝗼𝗿𝘁 (𝗨𝘀𝗲 𝗖𝗼𝗿𝗽𝗼𝗿𝗮𝘁𝗲 𝗘𝗺𝗮𝗶𝗹 𝗜𝗗 𝗳𝗼𝗿 𝗮 𝗤𝘂𝗶𝗰𝗸 𝗥𝗲𝘀𝗽𝗼𝗻𝘀𝗲):

https://www.datamintelligence.com/download-sample/eye-health-supplements-market

Driven strongly by the aging population and digitization, the eye health supplements market now appeals to both seniors managing age-related conditions such as macular degeneration, and younger consumers seeking protection from screen-related eye fatigue. Lutein and zeaxanthin dominate ingredient portfolios thanks to their AREDS2-backed efficacy in reducing the risk of age-related eye pathologies. The tablet segment captures 33.2% of the market, favored for reliable dosing and patient trust. Alongside North America’s dominance, Asia-Pacific is the fastest-growing region, influenced by a massive elderly population and spiraling rates of myopia and digital eye strain.

Key Highlights from the Report

➤ Global market size reached US$ 2.3 billion in 2024, with projections to reach US$ 3.9 billion by 2032.

➤ The tablet formulation segment captured a leading 33.2% market share in 2024, driven by dose accuracy and convenience.

➤ North America held the largest regional share at 36.2%, fueled by high preventive health awareness and supplement expenditure.

➤ Asia-Pacific is forecasted as the fastest-growing market, propelled by aging demographics and digital device proliferation.

➤ Lutein and zeaxanthin remain the cornerstone ingredients, validated by AREDS2 clinical studies for age-related macular degeneration.

➤ Major brands are innovating with easier-to-swallow softgel formats and vegan-friendly options to broaden demographic appeal.

Eye Health Supplements Market Segmentation

Market segmentation is fundamental to understanding product strategies and consumer preferences within the eye health supplements sector. The market is categorized based on ingredient type, formulation, indication, distribution channel, and region, each presenting distinct growth opportunities and competitive landscapes.

By Ingredient Type:

Lutein and zeaxanthin command substantial market share due to robust clinical support for their ability to prevent age-related macular degeneration (AMD) and cataracts. Secondary ingredient categories, including omega-3 fatty acids, antioxidants, coenzyme Q10, flavonoids, and alpha-lipoic acid, target broader vision protection and overall ocular wellness.

By Formulation:

The tablet segment leads at 33.2%, favored for precise dosage and pharmaceutical reliability, especially among elderly consumers requiring chronic care management for AMD and cataracts. The softgel segment is experiencing notable growth due to superior bioavailability and ease of swallowing, which appeals to both seniors and younger adults. Innovations in vegan-friendly and plant-based softgel technologies further support diverse dietary preferences. Capsules, liquids, and other forms cater to niche demands, such as rapid absorption and taste preferences.

By Indication:

Top indications driving demand include age-related macular degeneration (AMD), cataract prevention, glaucoma, and mitigation of digital eye fatigue. Rising rates of all these conditions, particularly in geriatric populations and screen-centric youth, continue to expand market opportunities.

By Distribution Channel:

Online channels are gaining prominence as tech-savvy consumers and seniors alike turn to e-commerce for convenience and direct access to specialty brands. Offline retail (pharmacies, health stores) retains a critical role for tried-and-true supplement formats, especially for prescription-strength products or those recommended by ophthalmologists.

By Region:

North America, Asia-Pacific, Europe, South America, and Middle East Africa each feature tailored product portfolios and unique market drivers, further discussed in the regional insights section.

Looking For A Detailed Full Report? Get it here:

https://www.datamintelligence.com/buy-now-page?report=eye-health-supplements-market

Regional Insights

North America stands at the forefront of the eye health supplements market, driven by advanced health literacy, a strong culture of preventive wellness, and widespread digital device adoption. The region boasts the highest per capita spending on supplements globally—over $150 per year. In this environment, both seniors and younger adults invest in supplements that address macular degeneration, cataracts, and screen-induced dryness. The US market benefits from the clinical validation of nutrients like AREDS2 formula, making these products a mainstay in ophthalmological recommendations. Robust retail and e-commerce infrastructure facilitate rapid market access.

In Canada, growth is supported by a mature market, an aging population, and strong public health education around AMD, the leading cause of vision loss in adults over 50. Natural and premium ingredient trends hold sway, particularly for products targeting dry eye syndrome.

Asia-Pacific emerges as the fastest-growing market, catalyzed by demographic shifts and lifestyle transformation. The region is home to more than 60% of the globe’s elderly population, amplifying the prevalence of conditions like cataracts and AMD. Digital device exposure in urban youth surpasses 6 hours daily, driving a new wave of digital eye strain and myopia. In India, over 35% of the population is online; myopia rates have more than doubled in a decade, fueling demand for lutein- and zeaxanthin-based supplements. In China, 80% of high school students are myopic, escalating demand for both preventive and therapeutic interventions. Chinese government policies to reduce myopia further empower the eye health supplement industry.

Europe, South America, and Middle East & Africa show variable trajectories shaped by healthcare accessibility, aging demographics, and local dietary norms. Emerging economies present opportunities for market expansion through affordable product innovation and strategic distribution partnerships.

Market Dynamics

Market Drivers

A major driver of the market’s expansion is the intensifying prevalence of digital eye strain—often referred to as "computer vision syndrome"—among adults and youth alike. Remote work, online learning, and pervasive smartphone usage cause symptoms from dryness to blurred vision, prompting widespread adoption of preventive supplements. A rapidly aging global population, projected to include over 2.1 billion people above age 60 by 2050, compounds this trend, elevating age-related macular degeneration and cataracts as compelling public health issues. Established clinical evidence in favor of lutein, zeaxanthin, and AREDS2-based nutrients continues to propel both consumer trust and physician endorsement for chronic eye health management.

Market Restraints

Despite impressive gains, growth is tempered by limited scientific validation for some supplement ingredients and complex regulatory barriers limiting new product launches. While staples such as lutein and zeaxanthin enjoy robust clinical support, skepticism persists around less-established compounds. Stringent health claims and approval processes can stymie innovation, slow adoption, and create hurdles for emerging brands seeking differentiation.

Market Opportunities

Ongoing innovation in formulation technology, such as the development of easier-to-swallow softgels and vegan-friendly capsules, is opening new demographic segments and boosting adherence rates. Rising consumer demand for sustainable, ethically sourced ingredients presents opportunities for brands committed to transparency, regenerative agriculture, and eco-friendly packaging. Advanced e-commerce and direct-to-consumer marketing strategies further empower niche formulations to rapidly reach targeted groups such as screen-saturated millennials, active seniors, and health-conscious families.

Get Customization in the report as per your requirements:

https://www.datamintelligence.com/customize/eye-health-supplements-market

Reasons to Buy the Report

✔ Gain in-depth, data-driven market intelligence with granular analysis on market size, pricing, and segmentation.

✔ Annual access to expert analyst consultations for strategic guidance and operational support.

✔ Stay ahead with quarterly white papers and case studies tailored to business challenges in eye health supplement markets.

✔ Receive yearly report updates, ensuring your insights reflect the latest technological and market developments.

✔ Specialized focus on emerging markets delivers actionable intelligence beyond generic global trends.

Frequently Asked Questions (FAQs)

◆ How Big is the Eye Health Supplements Market in 2024?

◆ Who are the Key Players in the Global Eye Health Supplements Market?

◆ What is the Projected Growth Rate of the Market through 2032?

◆ What is the Market Forecast for Eye Health Supplements by 2032?

◆ Which Region is Estimated to Dominate the Industry through the Forecast Period?

Company Insights

• Pfizer Inc.

• Bausch & Lomb Incorporated.

• Amway Corp.

• Vitabiotics Ltd.

• Alliance Pharma

• Bayer AG

• Nature’s Bounty

• The Nature's Way Company

• ZeaVision LLC.

• Swanson Health Products

Recent Developments:

-In September 2025, Bausch + Lomb launched an advanced eye health supplement containing lutein, zeaxanthin, and omega-3s to support macular and retinal function. The formulation targets digital eye strain and age-related vision decline.

-In August 2025, Nature’s Bounty introduced a plant-based vision care supplement fortified with astaxanthin and vitamin E, designed for individuals exposed to prolonged screen time and blue light.

-In July 2025, EyePromise expanded its nutraceutical line with clinically validated formulas focusing on contrast sensitivity, glare recovery, and protection from oxidative stress.

Conclusion

The eye health supplements market is experiencing sustained, data-driven growth, backed by mounting prevalence of vision disorders, an aging population, and surging digital eye strain across demographic segments. As consumer health literacy evolves and demand for clinical efficacy and sustainable sourcing accelerates, competitive advantage will rest with companies that prioritize transparent labeling, patented formulations, and personalized distribution strategies. Regional nuances and technological advances, particularly in Asia-Pacific and North America, continue to define industry trajectories, while opportunities abound for brands responsive to changing consumer preferences and regulator expectations. Industry players leveraging expert insights, regular report updates, and operational support are well positioned to navigate both risk and reward in this fast-evolving market landscape.

Sai Kiran

DataM Intelligence 4market Research LLP

877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.