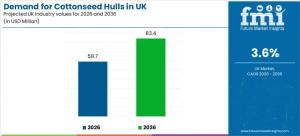

UK Cottonseed Hulls Market Expands USD 83.4 million by 2036 as Performance-Driven Buyers Reinforce Long-Term Demand

UK cottonseed hulls demand rises steadily as buyers prioritize functional performance, handling efficiency, & reliable supply across feed, & industrial uses.

NEWARK, DE, UNITED STATES, January 21, 2026 /EINPresswire.com/ -- The demand for cottonseed hulls in the UK is moving beyond commodity thinking and into performance-led procurement. Buyers across animal nutrition, fungal cultivation, and selected industrial applications increasingly treat cottonseed hulls as a functional input that must deliver predictable results. This shift underpins a market valued at USD 58.7 million in 2026, forecast to expand to USD 83.4 million by 2036, advancing at a steady CAGR of 3.6%.

Cottonseed hulls, a fibrous by-product of cottonseed processing, are primarily used as a roughage component in ruminant feed and as a structural substrate input in mushroom cultivation. In the UK, demand is not driven by volume alone. It is shaped by how consistently suppliers can deliver stable particle structure, controlled moisture levels, low contamination risk, and logistics efficiency for a low-density material where transport economics directly influence delivered cost.

Across high-throughput operations, adoption remains strong when cottonseed hulls improve operational outcomes. In fungal cultivation, substrate structure directly affects aeration, moisture retention, and yield stability. In animal nutrition, physical form influences feeding behavior, mix uniformity, and ration consistency. These performance outcomes define long-term purchasing behavior more than short-term price fluctuations.

Quick Stats: Cottonseed Hulls Demand in the UK

• Market valuation (2026): USD 58.7 million

• Forecast valuation (2036): USD 83.4 million

• Forecast CAGR (2026–2036): 3.6%

• Leading region: England

• Dominant form: Bulk

• Leading end use: Fungal cultivation

Why the UK Is Building Steady Demand for Cottonseed Hulls

Two purchasing logics dominate UK demand. The first is performance-led use in specialist production systems where physical structure matters. The second is value-led inclusion where fibre contribution and bulk properties are required at a controlled cost.

In animal nutrition, cottonseed hulls are valued for their fibre contribution in ruminant diets, supporting rumen function and feeding structure. UK feed buyers operate within clearly defined compliance frameworks, including the Animal Feed (Composition, Marketing and Use) regulations. These frameworks encourage disciplined procurement, documentation consistency, and repeatable formulations—factors that favor established, specification-controlled inputs.

Fungal cultivation represents a more technical use case. Research and commercial practice demonstrate that cottonseed hulls contribute to substrate stability, influencing yield reliability in oyster mushroom production. For growers operating at scale, predictable substrate behavior reduces batch variability and operational risk, reinforcing long-term supplier relationships.

Form and End-Use Segmentation Reflect Practical Efficiency

Segmentation in the UK cottonseed hulls market is defined by handling efficiency and end-use performance requirements.

Bulk form accounts for 65.4% of demand, reflecting buyer preference for straightforward loading, storage, and high-throughput dosing. Bulk supply suits operations that use hulls as a structural input rather than a precisely dosed additive. It aligns well with feed mills focused on roughage contribution and with cultivation facilities blending large substrate volumes.

Some procurement teams benchmark bulk hull sourcing alongside cotton-derived inputs such as cottonseed meal, aiming to optimize supplier relationships and logistics across multiple fibre and protein streams.

Fungal cultivation leads end-use demand with a 38.0% share. The dominance of this segment reflects the importance of substrate structure, aeration, and moisture behavior in controlled-environment agriculture. Operators prioritize materials that resist compaction, maintain porosity, and behave consistently across production cycles. Evidence from cultivation studies linking cottonseed hulls to yield and quality outcomes strengthens buyer confidence and repeat purchasing.

Additional End Uses Sustain Market Stability

Beyond cultivation and feed, cottonseed hulls support steady pull-through demand in other applications:

• Animal nutrition: Enhances fibre structure and feeding consistency in ruminant systems.

• Furfural production: Acts as a lignocellulosic feedstock aligned with bio-based chemical value chains.

• Wastewater treatment: Demonstrates adsorption potential, particularly when spent substrate is reused after cultivation.

These diversified applications reduce demand volatility and support baseline market resilience.

Market Dynamics, Opportunities, and Constraints

Demand stability is supported by cost-sensitive operations and the need for repeatable performance. Once buyers qualify a reliable specification, switching rates remain low. Compliance and audit readiness further reinforce structured vendor selection.

However, quality variability remains a key restraint. Inconsistent moisture, particle size distribution, or contamination can disrupt feed blending or compromise substrate performance. Logistics cost sensitivity also constrains growth, as low bulk density amplifies transport economics.

Opportunities for suppliers center on specification-controlled bulk supply, value-added processing such as pelleting or screened grades, and secondary use optimization of spent substrates. These pathways improve buyer efficiency while unlocking additional value from existing material flows.

Substitution risk persists where alternative fibre sources offer lower delivered cost or more stable supply. Regulatory tightening around traceability and documentation can also reshape supplier preferences.

Regional Demand Trends Across the UK

England leads growth at 3.9% CAGR, supported by dense clusters of high-volume buyers and stronger procurement scale. Scotland follows with steady uptake driven by specialist demand and reliability-focused purchasing. Wales emphasizes value discipline and performance fit, while Northern Ireland advances through selective qualification and smaller-scale adoption.

To explore detailed market data, segment-wise forecasts, and competitive insights, request a sample report. https://www.futuremarketinsights.com/reports/sample/rep-gb-31660

Competitive Landscape Defined by Consistency

Competition in the UK cottonseed hulls market centers on supply continuity, physical specification control, and documentation reliability. Mamta Cotton Industries, Pramoda Exim Corporation, Prem International, Shree Ram Proteins Ltd., and SMM TRADERS compete by delivering consistent bulk supply, managing dust and moisture, and aligning products with end-use performance needs.

For buyers, cottonseed hulls are no longer a filler. They are a functional input where consistency, handling efficiency, and predictable performance define value.

Key Industry Participants

• Mamta Cotton Industries

• Pramoda Exim Corporation

• Prem International

• Shree Ram Proteins Ltd.

• SMM TRADERS

Browse Related Insights

Cottonseed Hulls Market: https://www.futuremarketinsights.com/reports/cottonseed-hulls-market

Demand for Cottonseed Hulls in South Korea: https://www.futuremarketinsights.com/reports/south-korea-cottonseed-hulls-market

Demand for Cottonseed Hulls in USA: https://www.futuremarketinsights.com/reports/united-states-cottonseed-hulls-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1,200 markets worldwide.

Sudip Saha

Future Market Insights Inc.

+18455795705 ext.

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.